hey’re everywhere, green and hard to miss. You’ve probably used one of their services or perhaps you haven’t. Not just yet. But you’ve heard of them and seen their billboards around town. OPay landed quietly in Nigeria in 2018 as a payments solution but has since gained name recognition with its ubiquitous bike-hailing service.

What would you do if you had $50 million in funding from some of the world’s biggest names? If you’re OPay, you introduce various new services in the hopes of thoroughly decimating the competition. You leave people wondering: What the hell is OPay is actually doing?

In the beginning

The OPay story didn’t start in Nigeria. It began in 2017 in Norway.

In May 2017, the Norwegian internet company Opera announced a $100 million fund to invest in digital businesses in Africa, with $40 dedicated million to the Nigerian market alone. The company said the fund was aimed at improving financial inclusion and the African digital economy.

OPay emerged in December 2017 after an incubation period by Opera. It launched in Kenya as a payment service operated through an Opera subsidiary called O-Play Kenya Limited. In February 2018, OPay launched OKash, a quick loans platform, also managed by O-Play Kenya.

The Nigerian side of the OPay story, however, started in August 2018. In order to operate here, the company paid an undisclosed fee to acquire a controlling stake in PayCom, a fintech company founded by Telnet Nigeria. PayCom owned a licence to operate payment services in the country but was reportedly at risk of losing this after the Central Bank of Nigeria (CBN) proposed stricter financial licensing requirements. The OPay acquisition gave the company new life within a bold new play. Since the acquisition, PayCom has operated all OPay services in Nigeria and become a vehicle for Opera’s $40 million investment fund for the country.

OPay has since developed an ambitious consumer-facing payments platform. Its mobile app allows people to transfer money, pay bills and buy recharge cards. It also creates a bank account for users, allowing them to receive money by using Paycom as the name of their bank and their phone numbers as the account numbers. The app is also the centre of a wide range of services and offerings that OPay intends to use to ensure and cement its dominance of Nigeria’s fintech landscape.

Beginning in July 2018, OPay started using a network of agents to take its services to Nigeria’s unbanked population of 36.6 million people.

“The role of OPay’s agents is to help bring and take money out of the Opay mobile wallet,” Derrick Nueman, head of investor relations at Opera, explained to TechCabal. Within a year, the company grew quickly in Nigeria and this is where the OPay story gets interesting.

Where are OPay’s Agents?

In December 2018, OPay said it had 3,000 mobile money agents in the country. Four months later in April, it claimed this had grown to 10,000 agents. It jumped again to 20,000 in May. And by July, the company claimed it had 40,000 “active” agents across the country. This growth has been remarkably rapid, leading some industry insiders to question its veracity. By comparison, Paga, one of Nigeria’s biggest mobile money services, has 23,208 agents after almost a decade in business.

Osagie Alonge, the Director of Growth at OPay, said: “An agent is someone who uses the OPay platform to offer agent banking services and makes a profit from it. For us after installing the OPay app they have to do a KYC and agent registration.”

But there’s a visible and notable problem with OPay’s numbers: we can’t seem to find the agents anywhere.

– TECHCABAL

While competitors Paga and QuickTeller agents use kiosks and other means to remain visible, OPay developed “nearby agent”, an in-app feature for finding agents. It uses GPS to connect users with the nearest agents. It’s like Uber, but for OPay agents. We tried this feature, but it didn’t work. We tried it at different locations in Lagos and the response was consistent: “there are currently no agents nearby.”

After several unsuccessful attempts, we ditched the app and did some leg work to see if we could find an agent in any part of Lagos. We went to Surulere, Abule Egba, Iyana Ipaja, Ikeja, Mushin, Oshodi and Yaba for an OPay agent. We found none.

Alonge explained to TechCabal that the nearby agent feature “is still under development, it will be fully released in the coming weeks.

Meanwhile, a company insider told TechCabal that OPay’s agent network isn’t really big in Lagos. “Much of their focus is on locations outside Lagos,” the source revealed.

This sounds plausible. My colleague Wole Olayinka in Oyo state met two agents in the state capital, Ibadan: a man and his wife. “I didn’t know these people were agents until they told me, and then one of them brought out a jacket with “OPay” [printed] on it,” he told me.

OPay Business Verticals and Funding

Away from its agents, OPay has added new verticals atop of its payment platform.

In June, it launched ORide, a bike-hailing service. It has also introduced bus transport (OBus), tricycle-hailing (OTrike), food delivery (OFood) and wealth management (OWealth). Last month, the Nigerian OPay introduced OKash loans, a service facilitated by Kenya’s O-Play. These new services are all available from within the OPay app, turning it into a super app.

It secured its first external funding in July, receiving $50 million in funding from a group of Chinese investors including Sequoia China, IDG Capital, Source Code, GSR Ventures and Meituan-Dianping.

These investors represent China’s continued interest in Africa. In addition, investors like Sequoia China and Meituan-Dianping have experience backing loss-making unicorns. Sequoia China is an investor in Didi Chuxing the ride-hailing startup that lost over $1 billion in 2018. Didi forced out Uber in China by acquiring them and then backing Taxify in the markets where Uber operates in Africa and Europe.

Meituan-Dianping developed a super app for food delivery, ride-hailing, hotel booking and payments and this experience could prove useful to the Nigerian company.

With this funding round, Opera’s stake in OPay now stands at 19.9 percent. It is not clear what this stake is worth, but according to Opera’s second quarterly (Q2) report for 2019, it recorded a $4 million income gain “including a non-cash gain from the increased OPay valuation in connection with the company’s funding round.”

Although Opera has made OPay a separate company, they maintain “a close, mutually-beneficial relationship”, according to Nueman. He disclosed that the two companies will continue to “work together to promote each other’s services and products which serves as an effective way to cross-market their apps.”

ORide, OPay’s Aggressive Growth Service

So far, the biggest growth enabler for OPay appears to be ORide, its bike-hailing service.

Launched in June, ORide has grown aggressively. It uses huge discounts to attract new users and is now a serious competitor to older bike-hailing startups like Gokada and MAX. Barely two months after it launched in Lagos the service expanded to Ibadan, one of Nigeria’s largest cities.

During its Q2 earnings call on August 22, Opera disclosed that ORide now does as much as 100,000 rides per day – an incredible number. But its growth tactics using promos and subsidized rates could prove unsustainable as it burns through cash rapidly in search of growth. Uber, a company that employs similar tactics, recently lost $5 billion in one quarter and remains unprofitable after a decade in business. Few Africa-focused startups not named Jumia or backed by the Rocket Group have shown a similar appetite for such rapid and aggressive loss-fueled growth.

The bike hailing market is nascent and operates in a regulatory grey area in Lagos, Nigeria’s biggest city. For years the state government has maintained traffic laws that banned commercial motorbikes from operating on over 500 roads. There are also safety and bike capacity requirements.

However, the enforcement of these laws has been weak and allowed ORide and its competitors to emerge and continue to operate in the city. While these startups have met the safety and motorbike requirements, the road restriction laws remain, making them vulnerable to government action.

In July, we reported that the government was proposing a licence for bike-hailing startups that would address the regulatory gaps. The licence would cost ₦25 million (about $70,000) annually for 1,000 bikes, and a further ₦30,000 for every bike after the 1,000 mark. A license like this, replicated nationwide in multiple cities, could prove damaging for these startups.

Yet it’s not just the government action that affects these startups: road transport unions want them to fall in line and observe union practices. Since May, two of Nigeria’s biggest transport unions, the Road Transport Employers’ Association of Nigeria (RTEAN) and the National Union of Road Transport Workers (NURTW), have harassed bikers affiliated with these startups and demanded they buy tickets to operate in different parts of Lagos.

The government’s bike-hailing licence is expected to put an end to this harassment and ticket purchases. But months after the proposed license came to light, the government is yet to finalise. OPay’s Country Manager, Iniabasi Akpan, told TechCabal that conversations are still ongoing “with the Lagos State Government and the Road Transport Unions concerning the proposed license and ticketing fees, respectively.”

Meanwhile, ORide’s traction in recent months has been an important driver for OPay’s financial inclusion quest. TechCabal previously reported that the service’s uptake has grown particularly in rural locations and this has helped drive app usage in those areas. This puts the spotlight on another important issue: transaction volume.

How Much Is OPay Processing in Transactions?

Mirroring the growth of ORide, OPay claims its transaction volume has jumped since June. While announcing its funding round in July, the company disclosed that it processed $5 million worth of transactions daily. But according to Ridwan Olalere, the Director of Operations at ORide, that figure has doubled to over $10 million daily. Olalere, who was formerly OPay’s Head of Payments made the disclosure in August.

This figure is huge. But regardless of OPay’s aggressive growth, there are reasons for scepticism.

To begin with, Olalere’s sum translates to roughly ₦1.32 trillion ($3.65 billion) annually. In perspective, Flutterwave, the business to business fintech company, says it has processed over ₦900 billion ($2.5 billion) after 100 million transactions since 2016; while Paga has processed ₦1.5 trillion ($4.16 billion) since 2012. For OPay, a consumer-facing app with negligible enterprise element to its business to have surpassed Flutterwave’s transaction volume in just one year would be a remarkable achievement indeed.

Meanwhile, three days after Olalere shared his figure, Frode Jacobsen, Opera’s Chief Financial Officer, revealed that OPay’s daily transaction volume was around $7 million. Jacobsen made the revelation during Opera’s Q2 2019 earnings call. We contacted both an Opera spokesperson and Olalere for comments but they did not respond.

Fact-checking these figures is challenging because OPay is a private company and is not obligated to disclose its financials. So we checked public sources. Both the Nigerian Interbank Settlement Scheme (NIBSS) and a top source at one of Nigeria leading banks referred us to NIBSS data on mobile inter-scheme transactions. The NIBSS mobile inter-scheme transaction tracks all transactions done on mobile devices and its most recent data calls OPay’s reported figures into question.

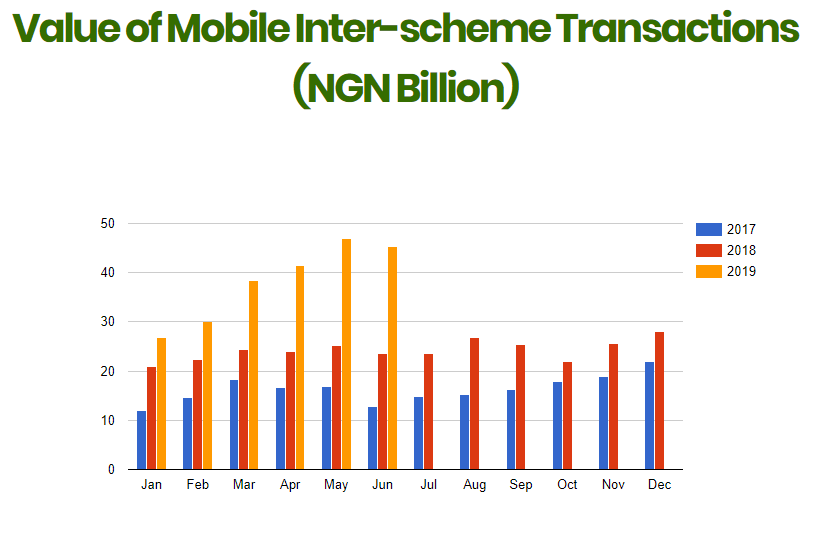

Graphs from the NIBSS show that mobile transactions have grown at an incredible rate this year compared to previous years.

Overall transaction volumes have nearly tripled so far in 2019 compared to 2017, while transaction values have equally grown. In particular, between April and June, the value of transactions is almost twice the figures recorded for the same period last year. In 2018, total mobile transactions value for the first six months stood at N140.6 billion ($388.2 million), but for the same period in 2019, this figure has grown to N229 billion ($632.2 million).

Although mobile transactions are growing, the value is still too small to accommodate the $7 million (or the $10 million) figure OPay claims it processes daily. In perspective, that figure translates to $210 million (or $300 million) monthly. This is more than a third of the value of all transactions processed by NIBSS so far this year.

According to a highly placed source at an OPay partner financial institution, the company is not actually doing these numbers.

OPay is our partner,” the source told TechCabal “[but] I think they are simply reporting these numbers in order to increase their valuation.”

– An OPAY FINANCIAL INSTITUTION PARTNER

OPay and Opera senior executives declined to comment when presented with both NIBBS data and their partner’s comments.

OEverything? Not Quite

OPay’s slew of rapidly launched services are impressive and contributing to the perception of the platform as an increasingly unstoppable juggernaut. It is important to note however that these services are being launched through a range of intricate partnerships and acquisitions that combine both OPay and Opera’s finances and operational capacity. According to Nueman, both companies continue to promote each other’s products.

For example, OList, a classifieds listing platform in Nigeria with 50,000 authorized advertisers, is owned by Opera; but it works in partnership with OPay. Meanwhile, in the case of OKash, Opera acquired the service from OPay in December 2018 for $9.5 million, but the service is still being promoted in Nigeria on the OPay app.

“OKash’s business (in Kenya, Nigeria, and everywhere) relies heavily on mobile processors,” Nueman said, “Opay is also helping OKash disburse and collect loans.”

Opera says both companies will continue to try out different services and see which one sticks. So any belief that OPay, by itself, has a long-term goal to enter all markets (“OEverything”) is an exaggeration at best. The company’s Country Manager, Iniabasi Akpan said the vision is to drive financial inclusion in the country especially for the informal economy.

OPay’s path to fintech domination will find it facing significant adversaries. One of those is MTN, Nigeria’s dominant telco for nearly two decades, which makes ₦1.04 trillion ($2.9 billion) in annual revenue and recently acquired a superagent fintech license to provide agent banking across the country. It is also vying for a Payment Service Banking (PSB) licence which would allow it to offer banking services in rural areas: the main target of financial inclusion schemes. In addition, OPay has competition in multiple directions. In the finance sector, it has to compete with banks, telecoms and other fintech startups. In mobility, the field is crowded by Gokada, MAX, EasyMobility, alongside bikes affiliated with road transport unions like the NURTW and RTEAN. On the food delivery front, it competes with services like Jumia Food and smaller food delivery services that operate within restricted locations.

In order to secure its dominance, it needs to win the battle on multiple fronts while growing thin-margin, money burning business segments. OPay is winning on optics, with its superior fundraising and rapid entry and growth into multiple fronts giving competitors a lot to think about. Actually winning and building a profitable, or even sustainable business will require much more than optics and well-hyped numbers.

Leave a Reply