Category: Uncategorized

-

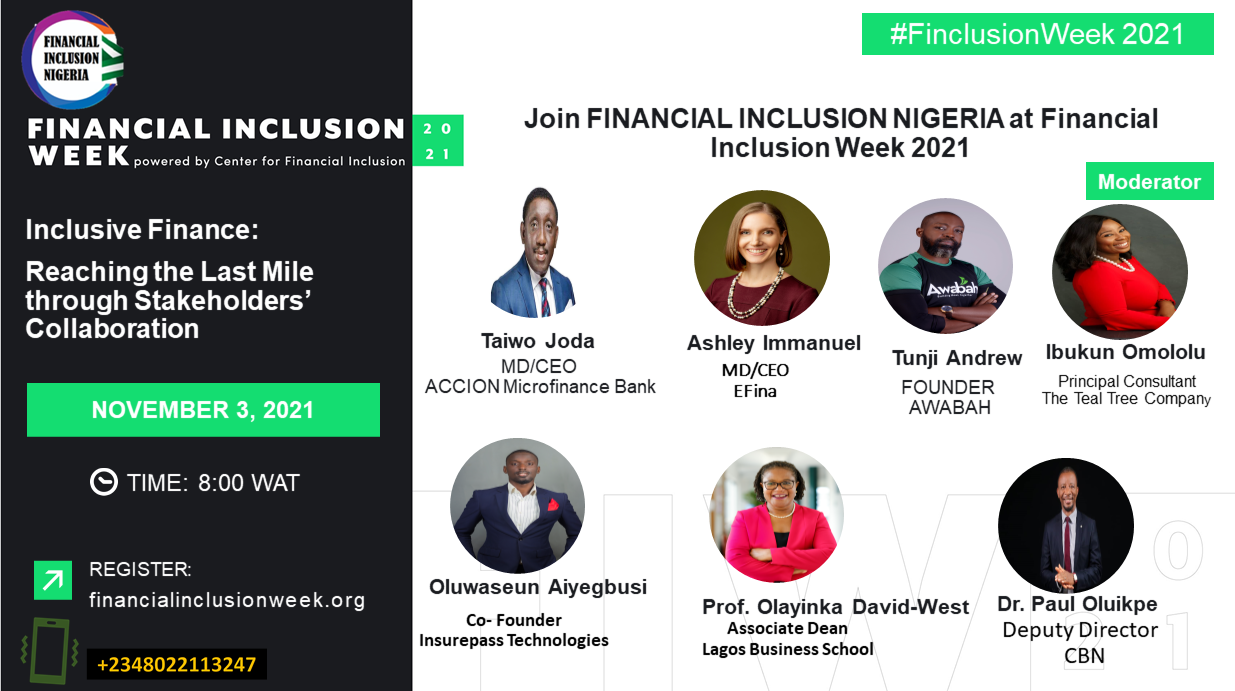

Financial Inclusion Week 2021

Reaching the unreached is always at the center stage of discussion in financial inclusion, different stakeholders strategically work to achieve inclusive finance through their product offerings and services. These range from Banking, Insurance, Pension, Digital Financial Services, Fintech, payment services, etc. In order to reach the last mile, there is a felt need for synergy…

-

Financial Inclusion Week 2021

The Center for Financial Inclusion (CFI) convenes FIW each year and invites partner organizations to showcase work, share ideas on what’s ahead and engage with the community. It is an annual, virtual gathering of the global community working to advance inclusive finance with the objective of exchanging ideas, developments, perspectives, and convening stakeholders all around the world.…

-

Leveraging Digitized Social Welfare Programs to Deepen Female Financial Inclusion in Africa

Global economies—from Nairobi to Beijing—are undergoing a rapid transformation, with digital technologies changing the way people communicate, work, bank, and access information. Today, previously unbanked households in Nigeria, Kenya and other nations of Africa can now access instant credit over their mobile phones. Rural households in Senegal are lighting their homes by linking their bank…

-

*FintechNGR Inaugurates Fintech Fund Advisory Team & the Nigerian Fintech Regluators’ Forum*

To address some of the challenges innovators/fintechs face in Nigeria, FintechNGR inaugurated the Fintech Fund Advisory Team and the Nigerian Reguvators’ Forum today, Monday, 7th September. The Fintech Fund Advisory Team was set up to develop a strategy to harness, harmonise and harvest various funding initiatives in Nigeria towards the take-off of an indigenous fintech…

-

MICROFINANCE BANKS AND THE UGLY MONSTER; COVID-19

Khanoba Collins: Chief Operating Officer, Letshego MFB. As we brace up for the gradual opening of businesses and MFBs returning to full operations in the coming days and weeks, the disruption from covid-19 will forever reshape our world of doing business. It is imperative for MFBs to immediately change the way they do business in…

-

FintechNGR Strategises Post-COVID-19 Intervention, Engages Sectors of its membership

The President of Fintech Association of Nigeria, Dr. Segun Aina and the Management led by Dr. Babatunde Obrimah in a bid to support its members and the ecosystem to weather the storm of economic and business impacts of COVID-19 and prepare them for post COVID-19 challlenges and opportunities, engaged in strategic discussions with the fifteen…

-

Fintech Association Webinar: Covid-19: Financial Implications and Solutions”

Fintech Association is organizing a virtual session on May 8, 2020, by 2 PM on COVID-19: Financial Implications and Solutions”. The session hopes to take a holistic look and give dimension to the economic and financial implications of COVID-19 pandemic on all economies as well as proffer radical and practical solutions to stemming an awkward…

-

Mobile payments rise 184% to reach N828bn

Financial transactions conducted by mobile money operators received a major boost in 2019 as the value of payments grew by 184 per cent from N292.02bn recorded in 2018. In 2019, the latest data obtained from the Nigerian Inter-Bank Settlement Scheme showed that N828.1bn worth of payments were executed by mobile money agents in the country.…

-

Financial Inclusion: Fintech firms got $400 million investment in 2019 – Emefiele

intech firms have seen capital inflow to the tune of $400 million this year, in efforts to build a more financially inclusive country. According to Punch, the Central Bank of Nigeria (CBN), through its governor, Mr Godwin Emefiele disclosed that this investment in fintech firms was part of the plan to improve the reach of financial services and…

-