Category: Financial Inclusion

-

Aisha Ahmad, Others To Chart Roadmap For Financial Inclusion

Deputy Governor, Financial Systems Stability Directorate, Central Bank of Nigeria (CBN) Aisha Ahmad will lead a stellar lineup of dignitaries for the annual Financial Inclusion Conference organised by leading financial sector development organisation, Enhancing Financial Innovation & Access (EFInA). The event scheduled for December 9, 2019, at the Eko Hotel and Suites, Lagos, seeks to…

-

‘Over 40m Nigerians Without Bank Account’

Yinka Kolawole in Osogbo Access Bank’s Group Head Retail Operations, Mr. Abraham Aziegbe, yesterday said over 40 million Nigerians were under-banked, adding that the situation had adversely affected economic development and growth of Nigeria over the years. He said the most pragmatic approach to such economic defect was to institutionalise financial inclusion in all the communities of Nigeria…

-

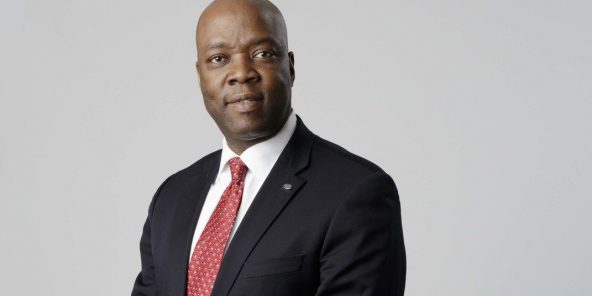

How Islamic Finance Can Deepen Financial Inclusion In Nigeria – Hassan Usman, MD, Jaiz Bank

On the sidelines of the 4th African International Conference on Islamic Finance, Bukola Akinyele of WebTV discussed with Mr Hassan Usman, MD/CEO, Jaiz Bank on “Islamic Finance as a Tool for Financial Inclusion in Nigeria”. Excerpts of the discussion appear below; Bukola Akinyele As Nigeria seeks to achieve 80% adult financial inclusion by 2020, Islamic finance…

-

Stakeholders At AICIF 2019 Urge For Expansion of Sukuk, Waqf and Takaful

Stakeholders at the just concluded 4th edition of the African International Conference on Islamic Finance, AICIF, agreed that there should be conscious steps to broaden the Sukuk, Waqf and Takaful finance and insurance options to improve infrastructure development, financial inclusion and economic prosperity in Africa. The submission of session speakers covered some key topics at the…

-

Mobile banking, a panacea to driving inclusion

As Nigeria intensifies efforts to improve its financial inclusion drive, the country has been urged to maximise the potential mobile banking technology can offer in deepening the initiative. This move becomes critical because of the digital disruptions the financial sector is witnessing, which have left commercial banks struggling to offset high operating costs of opening…

-

Sanusi Calls For Robust Regulatory and Legal Framework To Deepen Non-Interest Finance In Nigeria

The Emir of Kano HRH Muhammad Sanusi, II, CON has called for robust regulatory and legal framework to deepen non-interest finance in Nigeria. This, according to him, was an essential condition to the sustainable growth of alternative financing models in the country. He made this assertion as keynote speaker at the 4th African International Conference on…

-

Infrastructure Financing, Sustainability and the Future of African Markets

AICIF NEWS RELEASE All is set to host the 4th African International Conference on Islamic Finance (AICIF), which is scheduled to hold on Monday 4th and Tuesday, 5th November 2019. The two-day event, which will take place at Eko Hotels & Suites, Victoria Island, Lagos, will bring together experts in finance, infrastructure and various other…

-

Ecobank Says No Charges on USSD Transactions, Seeks Stakeholders’ Collaboration

Ecobank Nigeria has announced that access to its *326# Unstructured Supplementary Service Data (USSD) is at zero cost to the consumer. By this announcement an Ecobank customer who performs transactions on the bank’s platform by dialing *326# is free of the USSD session fee. Patrick Akinwuntan, Managing Director, Ecobank Nigeria who declared this at the…

-

Reasoning together on CBN’s efforts to curtail voluminous cash

[FILES] Central Bank of Nigeria’s (CBN) governor Godwin EmefieleThe power of cash comes from the fact that it is tangible; this mystique is what ensures that a set of rectangular notes or circular coins can give effect to the laws of demand and supply. This character confers physical money with the overwhelming influence it possesses…

-

Anticipated Gains of CBN’s Financial Inclusion Policy

Nkechi Ibe The overall objective of financial inclusion as stipulated in the 2018 Annual Report National Financial Inclusion Strategy (NFIS) Implementation is to bring the underserved segment of the population (unbanked population) into the formal financial system by providing them with access to financial services. The policymakers argue that an improved access to finance is…