Category: Financial Inclusion

-

Eyowo to ease business operations with new solutions

Building on its platform, financial solution company, Eyowo Integrated Payment Limited, has unveiled new solutions to boost business operations in Nigeria. Prior to the latest innovation, Eyowo had unveiled its peer to peer payment solution, which allows people to send and receive money, buy airtime, pay bills through their mobile phones. To take businesses through…

-

Telecom infrastructure driving financial services – Danbatta

Ife Ogunfuwa The Executive Vice-Chairman and Chief Executive, Nigerian Communications Commission, Prof. Umar Danbatta, has said that telecommunications remained the best enabler in expanding the frontiers of financial inclusion in Nigeria. He said this at the NCC head office while receiving a team from the Bill and Melinda Gates Foundation and the foundation’s consultants, Glenbrooks…

-

KPMG: FirstBank reinforces retail banking dominance, creates 150,000 indirect jobs

By Collins Nweze The unbanked and underbanked, two groups at the centre of retail banking, need to be captured for the financial system to achieve its full potential. The KPMG Nigeria Banking Industry Customer Experience Survey says customers have expectations about how their needs will be met and meeting this requires banks deploying the right…

-

Microfinance in Nigeria: An Outlook for the next decade

Adolphus Areban Abraham As we enter a new decade, it is imperative for us to take a projective view of microfinance. Potential investors, whose interest this column seeks to focus should be able to decide if their investment will extinguish should they decide to enter the industry today or within the decade. They should be…

-

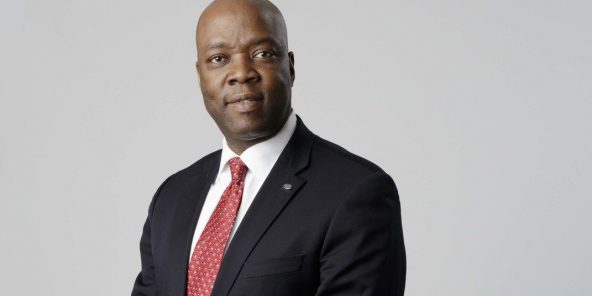

FirstBank CEO Adeduntan gets global recognition

First Bank of Nigeria Limited has under its Chief Executive Officer, Adesola Adeduntan positioned the brand as a clear leader in promoting financial inclusion in Nigeria. The bank has continually reached the underbanked and un-banked population to reduce poverty, bolster economic growth and development of Nigeria. These milestones have earned Adeduntan the 2019 Cranfield University…

-

2020, a year to turn around insurance industry — NAICOM

The National Insurance Commission (NAICOM) says 2020 is a year to turn around the fortunes of the insurance industry. Mr Sunday Thomas, Acting Commissioner for Insurance, said this on Monday, at the 2020 seminar the commission organised for journalists covering the insurance sector. The seminar, with the theme `Strategic Focus of the Commission in Year…

-

Reduced bank charges’ll enhance financial inclusion –Ecobank MD

The Managing Director, Ecobank Nigeria, Patrick Akinwuntan, says the Central Bank of Nigeria’s recent directive on the reduction of bank charges will help to drive financial inclusion. In a statement by the bank, Akinwuntan said Ecobank had complied with the CBN’s directive and commended the regulator for taking bold steps to strengthen the financial inclusion…

-

CBN, Banks Introduce New Measure to Boost Financial Inclusion

Obinna Chima As part of efforts to enhance financial inclusion in the country, the Central Bank of Nigeria (CBN) and banks, under the aegis of the Bankers’ Committee, have concluded plans to simplify the requirements for the Bank Verification Number (BVN) for certain types of transactions. CBN Governor, Mr. Godwin Emefiele, disclosed this yesterday, while…

-

Experts identify ways to extend boundaries of CBN’s financial inclusion strategy

Experts, who gathered at the Inclusive Finance Nigeria Conference and Awards (IFINCA) have identified the various ways the Central Bank of Nigeria (CBN) can extend the boundaries of financial inclusion strategy in the country. In a circular, the CBN had said it was not meeting any of the financial inclusion target agreed and contained in the…

-

Players in Nigeria’s micro finance sector must leverage on digital technology to deepen financial inclusion.

Stakeholders at the recently held 2019 Accion Microfinance Bank Seminar on Financial Inclusion emphasized the need for Microfinance banks to leverage digital technology to increase their lending activities, deepen financial inclusion and expand micro, small and medium -scale sector businesses. The event themed “Re-Emerging Microfinance Banks: Digital Reality” brought together regulators, members of the academia,…