Author: admin

-

Stanbic IBTC introduces initiative to drive micro pension.

Nike Popoola Following the formal introduction of the micro pension plan by the Federal Government in March, Stanbic IBTC Pension Managers Limited, has unveiled a nationwide micro pension campaign tagged ‘Game Plan – Retire Well.’ The Pension Fund Administrator said the effort was aimed at sensitising and stimulating the informal sector not covered by the…

-

Banks enrol 65,753 mobile money agents.

Chances of the Central Bank of Nigeria (CBN) meeting its target of having 500,000 mobile money agents to serve about 105 million adult Nigerians by the year 2020 looks increasingly remote, as financial institutions in the country have so far enrolled only 65,753 of such agents. This means that with less than two years to…

-

Visa Launches Visa B2B Connect In 30+ Markets.

It was late November 2017 when the world got its public preview of Visa B2B Connect at the Singapore FinTech Festival. It was described then as an idea to solve the many frictions inherent in sending money from one bank account to another across borders, typically between corporates — and of a large denomination. “From…

-

MTN creates subsidiary for mobile financial services

Ife Ogunfuwa MTN Nigeria has registered a new subsidiary with the Corporate Affairs Commission, Yello Digital Financial Service Limited. The subsidiary, which has yet to commence operations, was created in June 2018 to provide mobile financial services to Nigerians. The creation of a subsidiary is one of the requirements stipulated by the Central Bank of…

-

Financial inclusion drive is gaining momentum in the country as Nigeria embraces electronic payment channels.

Nigerians transacted businesses worth N183.4 billion through mCASH in the first three months of this year. New Telegraph learnt that the mobile payment platform, which was recently re-launched by the Nigerian Inter-bank Settlement Systems (NIBSS) in partnership with banks and telecom operators, is now gaining traction among mobile users. mCASH is a mobile payment system…

-

Microfinance Banks in Nigeria- The Prospects.

Jola-michael Samson. T : Financial Inclusionist. Provision of loans is what most people know about microfinance; it is also the provision of payments services to the low-income earner. Microfinance Bank was established by the Central Bank of Nigeria (CBN) to provide these services in order to alleviate poverty. It is evident that this goal has…

-

MTN Group launches Africa’s first artificial intelligence service for Mobile Money.

MTN Group is proud to announce the launch of Africa’s first Mobile Money (MoMo) artificial intelligence service or “chatbot”. The chatbot went live in Ivory coast in May and will be rolled out across MTN’s MoMo footprint in the next few months. The artificial intelligence mobile money “assistant” enables customers to engage with MTN’s MoMo…

-

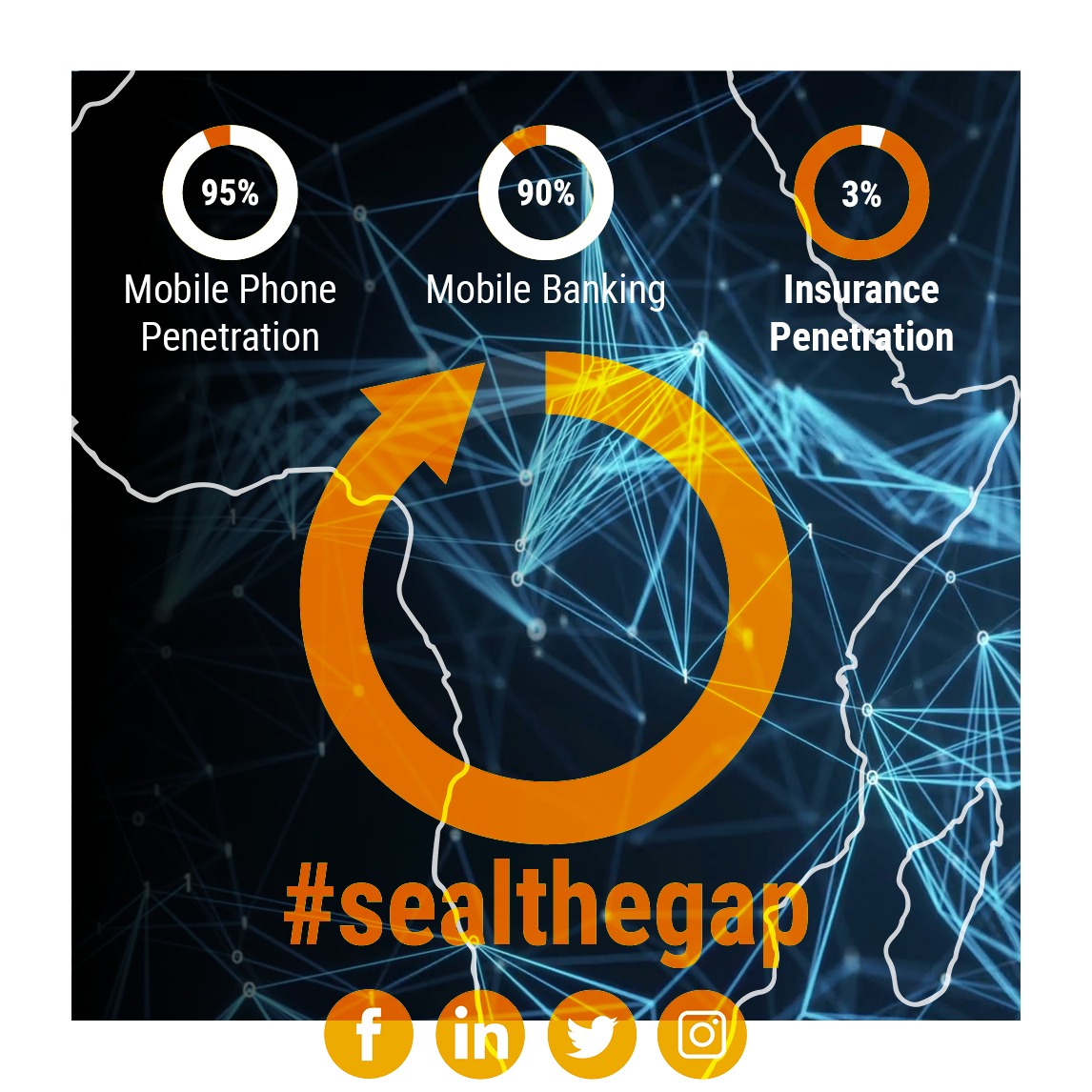

Insuretech Conference.

https://www.africa3point0.com/ On July 15th & 16th East Africa’s new insurance ecosystem is being launched in Nairobi. The focus of the event is the symbiosis of InsurTech & FinTech sectors with AgriTech and HealthTech to seal the insurance gap, develop resilience to climate change, secure the future of local and international businesses and address the vulnerability…

-

The Financial Inclusion Journey: Emergence of Digital Wallets in Nigeria.

A digital wallet also known as “e-wallet” refers to an electronic device or online service that allows an individual to make electronic transactions. This can include purchasing items on-line with a computer or using a smartphone to purchase something at a store. An individual’s bank account can also be linked to the digital wallet. (Wikipedia)…