Fintech Specialist

A digital wallet also known as “e-wallet” refers to an electronic device or online service that allows an individual to make electronic transactions. This can include purchasing items on-line with a computer or using a smartphone to purchase something at a store. An individual’s bank account can also be linked to the digital wallet. (Wikipedia)

In more recent times in the Nigerian payments landscape we’ve had a large push in the direction of a Cashless society as well as a financially included economy.

One thing we however have not agreed on is how to go about it.

The ever growing payments space in Nigeria however has continued to evolve and redefine the payments experience for the growing number of the financially included whilst also including avenues to make payment services more appealing to and easily accessible to the financially excluded.

Essentially, we’ve seen the advent of various digital

wallets that have been designed to either foster cashless transacting or bridge

the financial exclusion gap.

I’d backtrack a little and briefly share with us what the World Bank defines

financial inclusion as.

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way.

Being able to have access to a transaction account is a first step toward broader financial inclusion since a transaction account allows people to store money, and send and receive payments. A transaction account serves as a gateway to other financial services, which is why ensuring that people worldwide can have access to a transaction account is the focus of the World Bank Group’s Universal Financial Access 2020 initiative. (World Bank Financial Inclusion Overview)

As stressed by the World Bank that transaction inclusion is merely a gateway to financial inclusion, it’s shocking to know that there is hardly any digital financial service provider in Nigeria that can boast of being an end-to-end financially inclusive platform (Banks inclusive). At best you’d have the likes of QuickTeller, Carbon and most of the commercial banks that check 3 or 4 of the 5 boxes made up of Transactions, Payments, Savings, Credit & Insurance.

Why Digital Wallets?

Equally important is the means of administering this services to the end users but before we delve into that, find below this interesting report that perhaps shares some insight into why most parties opted for the delivery channels that they make use of.

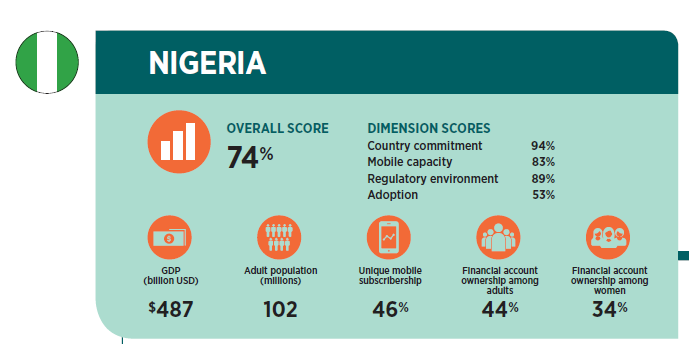

This report shows that whilst Nigeria as a country is quite receptive to the quest of financial and digital inclusion it has not been able to translate into high adoption. Mobile penetration however would appear to be a potential entry point to increase the 44% financial account ownership among adults. So far, alternate means of administering financial services in Nigeria considering the prevention of Telcos from playing in the mobile money space include but is not limited to:

- Mobile (Android, iOS, QR & USSD)

- Web

- Agents (Web, Android & PoS)

- Cards (Physical & Virtual)

Digital Wallets in Nigeria.

The ultimate product for me would be the one that checks all these boxes

Obviously the transactional side of things which is the gateway to financial inclusion is covered by all these digital wallets, next steps would be to extend the outstanding services to their customer base and get them to be truly financially included.

Security:

The Nigerian payments space thanks to the ever

present arms of the regulatory bodies has been quite big on security and what

you would usually have is the compliance to 2 Factor authentication and PCI

rules as may apply across these platforms.

Some of them would even go the extra mile of including other measures such as

biometric authentication, tokenization etc. which mitigates against unwanted

access

What about USSD?

It has been argued that USSD perhaps because of its simplicity and ease of use would have a great part to play in reaching the bottom of the pyramid in terms of the financially excluded especially with the enviable performance of USSD poster child – GTBank’s *737#.

I am personally of the opinion that it stands the chance of playing a huge role as long as it can perform the following functions:

- Open a transaction account

- Carry out transactions

- Initiate Savings & Investments

- Access Credit

- Buy Insurance

Conclusion:

The future is exciting and it is a lot nearer than it was a while back.

Opportunities abound in this unique market segment and I predict that more

businesses like this would spring up to deliver full-blown Digital Financial

services that would be truly inclusive. It may be in form of Digital Banks like

Alat (a lot of those are springing up already

e.g Nest Bank, Rubies) or existing Digital Wallets like Carbon that would

expand and leverage strategic partnerships to be fully inclusive and hit the

all elusive 5/5.

Leave a Reply